Image Credit: fizkes / Shutterstock

Americans have increasingly turned to credit cards to meet their household financial needs—but doing so has dramatically raised risks of credit card fraud in recent years.

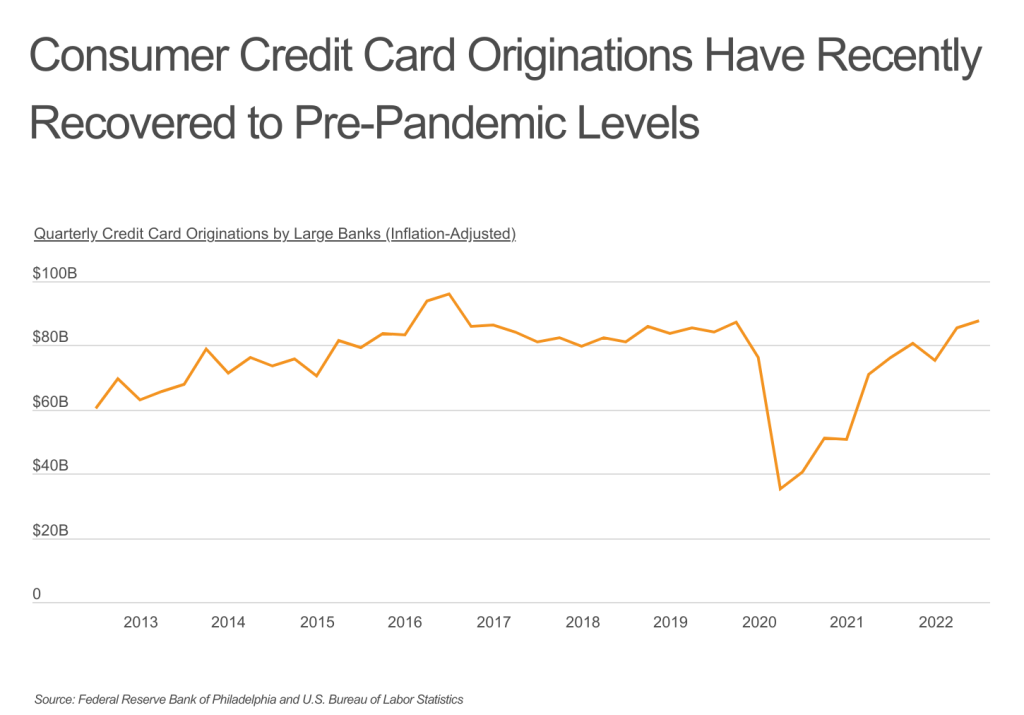

The early months of the COVID-19 pandemic saw many households reduce reliance on credit thanks to increased savings rates and government stimulus payments. Consumers paid off credit card balances at a record pace and applied for credit less often. But with high inflation over the past two years, Americans’ need for credit cards has rebounded as household costs have increased.

The aggregate, inflation-adjusted credit limit for newly issued consumer credit card accounts in the first quarter of 2020 was around $76 billion, but that figure fell by more than half to $35 billion in the second quarter of 2020 as pandemic lockdowns and stimulus measures took effect. Limits began to climb quickly again in 2021 as inflation took hold, and by the end of 2022, banks issued new consumer credit at the highest levels since 2016.

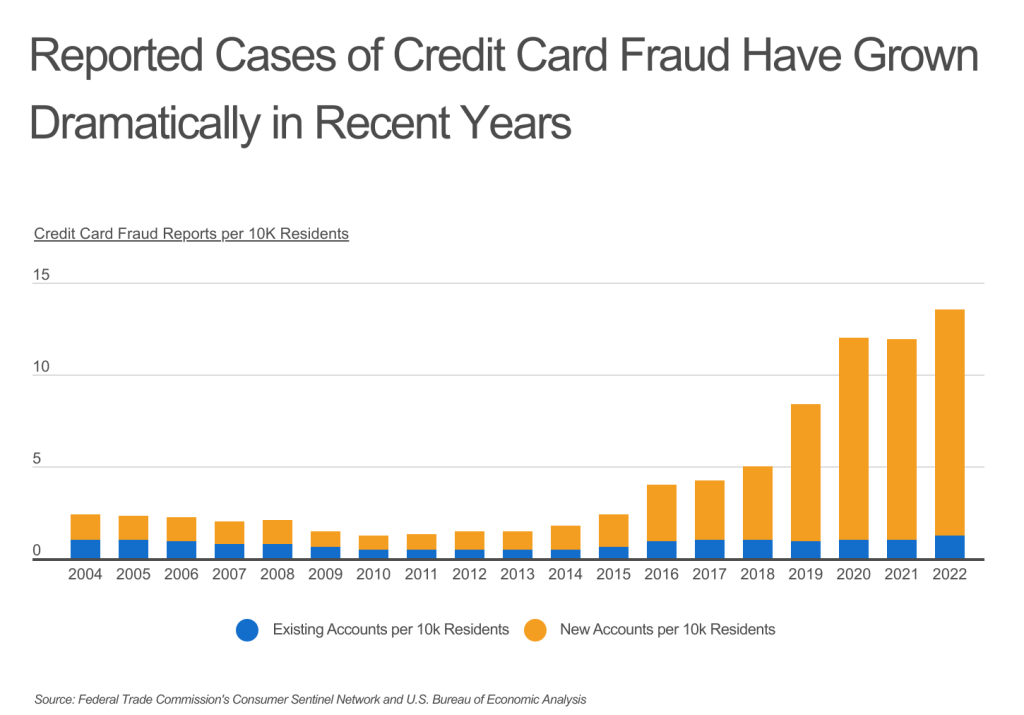

But with the rise in credit card usage comes increased risk for consumers as well—most notably from credit card fraud. Such fraud typically occurs in two forms: account takeover and application fraud. Account takeover fraud takes place when a bad actor obtains credentials or other personal information to gain access to the cards, funds, or other benefits associated with an existing account. Application fraud happens when a bad actor attempts to open new credit card accounts in another person’s name using personal information or counterfeit documents.

Credit card fraud has spiked overall, with reported fraud cases approximately tripling over the last five years. However, the bulk of the increase over time has come through application fraud. Reported cases of fraud from new accounts have risen tenfold within the last two decades, from 1.4 reports per 10,000 residents in 2004 to 14 per 10,000 in 2022. With phishing scams becoming more sophisticated and many major companies experiencing data breaches, malicious actors today have more ways to obtain personal information needed to commit credit card fraud.

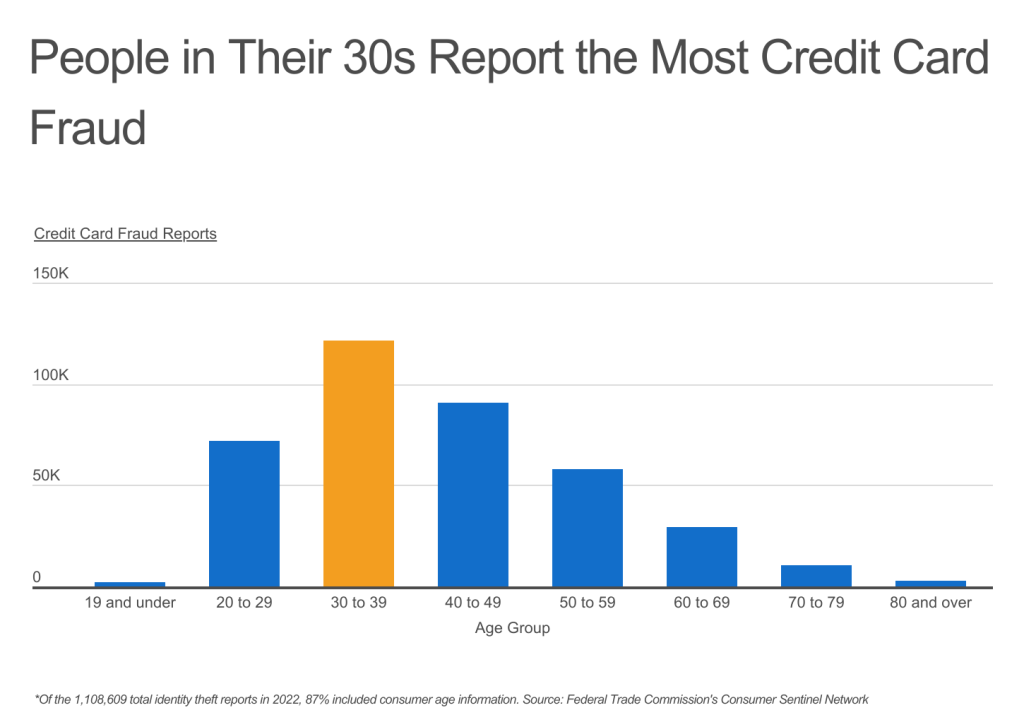

While credit card fraud is on the rise overall, some parts of the population may be at greater risk. People aged 30 to 39 make nearly 125,000 reports of credit card fraud per year, the most of any age group. People in this age group may be more comfortable sharing information online, making them potentially vulnerable to fraud. Past the 30-39 bracket, the total number of fraud reports declines with age, with U.S. residents aged 80 and over reporting just 2,566 cases of credit card fraud annually.

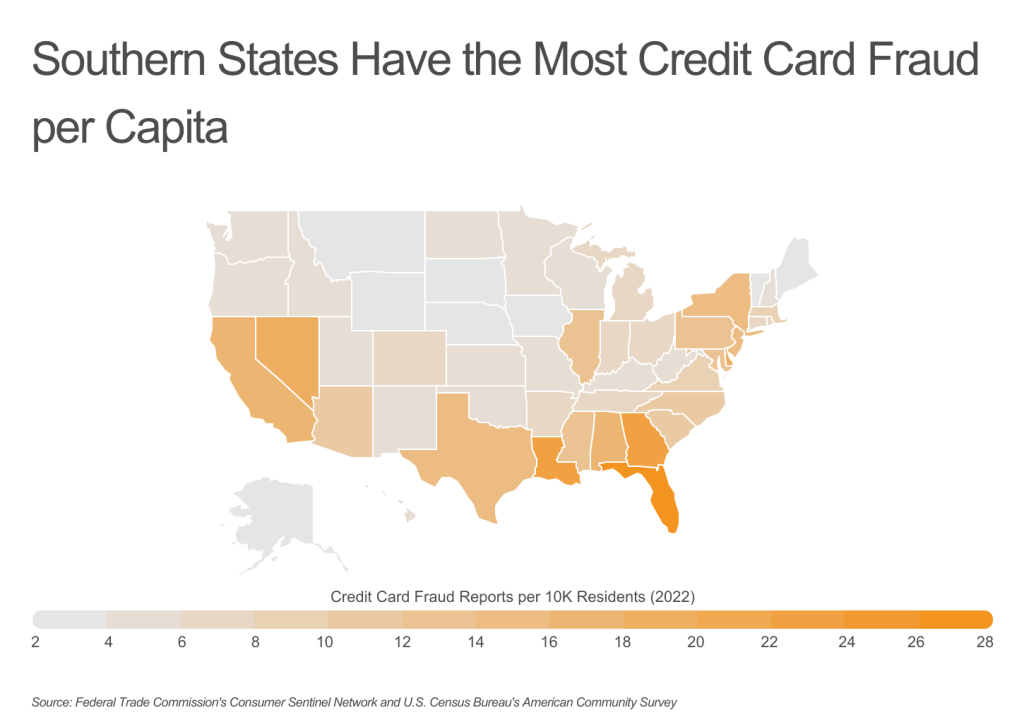

Credit card fraud is also more common in different geographic regions of the U.S. The central U.S. and New England have lower rates of fraud, while the Southwest and especially the Southeast U.S. experience fraud more frequently. And among these locations, Florida stands out. The state leads the U.S. in fraud reports per 10,000 residents at 26.9, while Miami leads all large cities with a whopping 51.4 reports per 10,000 residents—nearly 4 times the national rate of 13.5.

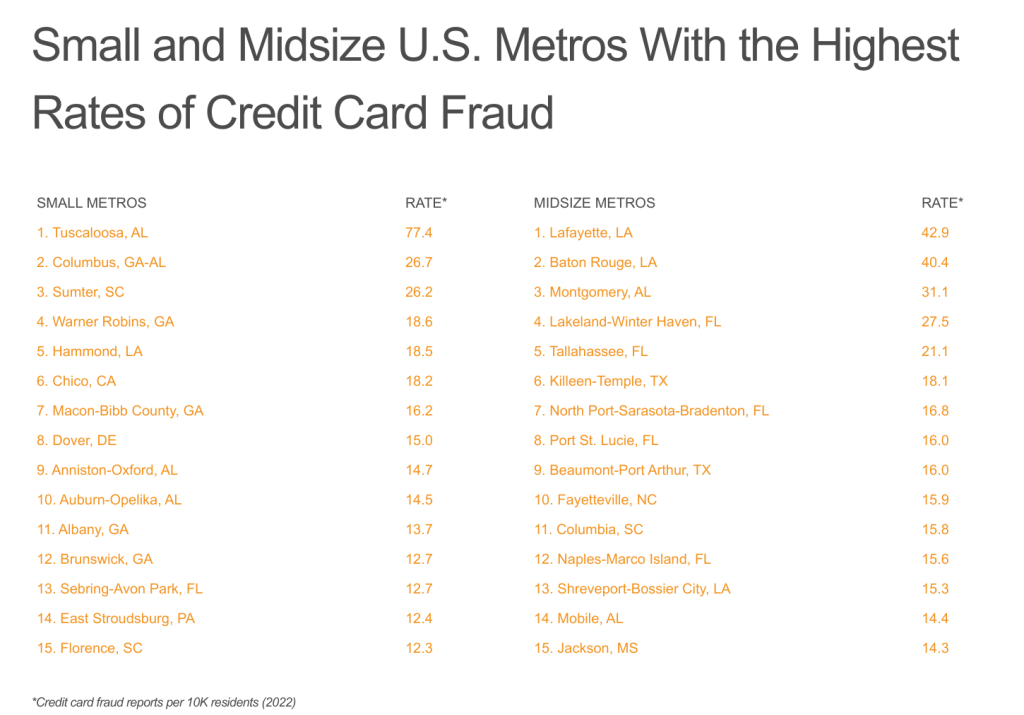

At the metro-level, the highest density of reported credit card fraud occurs in the Deep South. Southern metropolitan areas like Atlanta (33.1), Orlando (31.4), and Houston (26.2) all rank in the top 5 large metros with the most credit card fraud reports per 10,000 residents. In fact, the Deep South is home to 12 of the top 15 small-sized metros like Tuscaloosa, Alabama and 14 of the 15 top midsize metros for credit card fraud. Outside of the southern United States, Los Angeles, California, and New York City rank 4th and 12th, respectively.

To determine the locations with the highest rates of credit card fraud, researchers at Upgraded Points analyzed the latest data from the Federal Trade Commission and the U.S. Census Bureau. The researchers ranked locations by their per capita rates of credit card fraud reports in 2022. In the event of a tie, the location with the largest total number of credit card fraud reports was ranked higher.

Here are the U.S. metropolitan areas with the highest rates of credit card fraud.

Large U.S. Metros With the Highest Rates of Credit Card Fraud

Photo Credit: ESB Professional / Shutterstock

15. Richmond, VA

- Credit card fraud reports per 10K residents (2022): 15.7

- Total number of credit card fraud reports (2022): 2,070

- Year-over-year change in credit card fraud reports: +66.8%

- 3-year change in credit card fraud reports (2019-2022): +174.5%

Photo Credit: Sean Pavone / Shutterstock

14. Birmingham-Hoover, AL

- Credit card fraud reports per 10K residents (2022): 17.3

- Total number of credit card fraud reports (2022): 1,926

- Year-over-year change in credit card fraud reports: +16.9%

- 3-year change in credit card fraud reports (2019-2022): +82.4%

Photo Credit: Bonnie Fink / Shutterstock

13. Tampa-St. Petersburg-Clearwater, FL

- Credit card fraud reports per 10K residents (2022): 17.4

- Total number of credit card fraud reports (2022): 5,616

- Year-over-year change in credit card fraud reports: +44.3%

- 3-year change in credit card fraud reports (2019-2022): +101.9%

Photo Credit: Lukas Uher / Shutterstock

12. New York-Newark-Jersey City, NY-NJ-PA

- Credit card fraud reports per 10K residents (2022): 17.5

- Total number of credit card fraud reports (2022): 34,507

- Year-over-year change in credit card fraud reports: +8.4%

- 3-year change in credit card fraud reports (2019-2022): +43.0%

Photo Credit: Francisco Sandoval Guate / Shutterstock

11. Dallas-Fort Worth-Arlington, TX

- Credit card fraud reports per 10K residents (2022): 17.6

- Total number of credit card fraud reports (2022): 13,682

- Year-over-year change in credit card fraud reports: +8.6%

- 3-year change in credit card fraud reports (2019-2022): +28.5%

Photo Credit: Jon Bilous / Shutterstock

10. Charlotte-Concord-Gastonia, NC-SC

- Credit card fraud reports per 10K residents (2022): 18.8

- Total number of credit card fraud reports (2022): 5,088

- Year-over-year change in credit card fraud reports: +47.9%

- 3-year change in credit card fraud reports (2019-2022): +132.1%

Photo Credit: evenfh / Shutterstock

9. New Orleans-Metairie, LA

- Credit card fraud reports per 10K residents (2022): 20.3

- Total number of credit card fraud reports (2022): 2,565

- Year-over-year change in credit card fraud reports: -8.6%

- 3-year change in credit card fraud reports (2019-2022): +79.7%

Photo Credit: f11photo / Shutterstock

8. Memphis, TN-MS-AR

- Credit card fraud reports per 10K residents (2022): 21.7

- Total number of credit card fraud reports (2022): 2,899

- Year-over-year change in credit card fraud reports: -35.1%

- 3-year change in credit card fraud reports (2019-2022): +74.2%

Photo Credit: Andrey Bayda / Shutterstock

7. Las Vegas-Henderson-Paradise, NV

- Credit card fraud reports per 10K residents (2022): 22.6

- Total number of credit card fraud reports (2022): 5,179

- Year-over-year change in credit card fraud reports: +0.1%

- 3-year change in credit card fraud reports (2019-2022): +100.9%

Photo Credit: Gang Liu / Shutterstock

6. Philadelphia-Camden-Wilmington, PA-NJ-DE-MD

- Credit card fraud reports per 10K residents (2022): 23

- Total number of credit card fraud reports (2022): 14,340

- Year-over-year change in credit card fraud reports: +11.4%

- 3-year change in credit card fraud reports (2019-2022): +143.6%

Photo Credit: travelview / Shutterstock

5. Houston-The Woodlands-Sugar Land, TX

- Credit card fraud reports per 10K residents (2022): 26.2

- Total number of credit card fraud reports (2022): 18,846

- Year-over-year change in credit card fraud reports: -4.8%

- 3-year change in credit card fraud reports (2019-2022): +95.8%

Photo Credit: Chones / Shutterstock

4. Los Angeles-Long Beach-Anaheim, CA

- Credit card fraud reports per 10K residents (2022): 28.7

- Total number of credit card fraud reports (2022): 37,348

- Year-over-year change in credit card fraud reports: +2.1%

- 3-year change in credit card fraud reports (2019-2022): +23.9%

Photo Credit: Songquan Deng / Shutterstock

3. Orlando-Kissimmee-Sanford, FL

- Credit card fraud reports per 10K residents (2022): 31.4

- Total number of credit card fraud reports (2022): 8,442

- Year-over-year change in credit card fraud reports: +21.5%

- 3-year change in credit card fraud reports (2019-2022): +164.6%

Photo Credit: Luciano Mortula – LGM / Shutterstock

2. Atlanta-Sandy Springs-Alpharetta, GA

- Credit card fraud reports per 10K residents (2022): 33.1

- Total number of credit card fraud reports (2022): 20,319

- Year-over-year change in credit card fraud reports: -5.9%

- 3-year change in credit card fraud reports (2019-2022): +36.7%

Photo Credit: Just dance / Shutterstock

1. Miami-Fort Lauderdale-Pompano Beach, FL

- Credit card fraud reports per 10K residents (2022): 51.4

- Total number of credit card fraud reports (2022): 31,341

- Year-over-year change in credit card fraud reports: +21.7%

- 3-year change in credit card fraud reports (2019-2022): +58.6%

Methodology & Detailed Findings

To determine the locations with the highest rates of credit card fraud, researchers at Upgraded Points analyzed the latest data from the Federal Trade Commission’s Consumer Sentinel Network Data Book 2022 and the U.S. Census Bureau’s 2021 American Community Survey. The researchers ranked locations by the largest reported credit card fraud incidents per 10,000 residents. In the event of a tie, the location with the largest total number of credit card fraud reports was ranked higher.

To improve relevance, only metropolitan areas with at least 100,000 people were included in the analysis. Additionally, metro areas were grouped into the following cohorts based on population size:

- Small metros: 100,000–349,999

- Midsize metros: 350,000–999,999

- Large metros: more than 1,000,000

Final Thoughts

Despite a decline in credit card reliance during the COVID-19 pandemic—when many consumers actually paid off their balances, and applied for new credit less often—subsequent inflation has caused many Americans to rely on credit cards once again to meet their financial needs. With this comes the increased risk of credit card fraud, as well.

Though credit card fraud of any kind has increased, the two most typical occurrences are account takeover and application fraud, which has seen a tenfold increase in the last 20 years as more sophisticated scams emerge and data breaches become more common.

Rates of credit card fraud are highest among people aged 30 to 39, who may share information online more often, increasing their vulnerability. By contrast, people aged 80 or higher report significantly lower rates of credit card fraud.

In addition to age, geography plays a role: the central U.S. and New England experience fewer fraud reports, while the Southwest and Southeast have higher figures. Florida leads U.S. states with 26.9 fraud reports per 10,000 residents—and its largest metro, Miami, leads all cities at 51.4 reports per 10,000 residents.