Retail credit cards, also known as store-issued credit cards, play a significant role in consumer credit and serve as a key revenue stream for many stores. In fact, retailers have issued credit cards for longer than financial institutions, beginning the practice as a type of credit for loyal customers. Store cards today typically offer discounts or other perks for their loyal shoppers, and retailers have evolved to issue both closed-loop cards (which can only be used within certain stores or chains) as well as open-loop cards (which can be used more widely).

While store-issued cards often carry more restrictions, lower credit limits, and higher rates and fees than standard bank-issued cards, they are also generally easier to obtain, making them appealing not only for loyal shoppers but also for those with limited or middling credit. However, amid recent shifts in the credit industry—including a proposed federal rule that would curb how much card issuers can charge in fees—retail card companies are facing serious headwinds.

Declining Interest in Retail Store Credit Cards

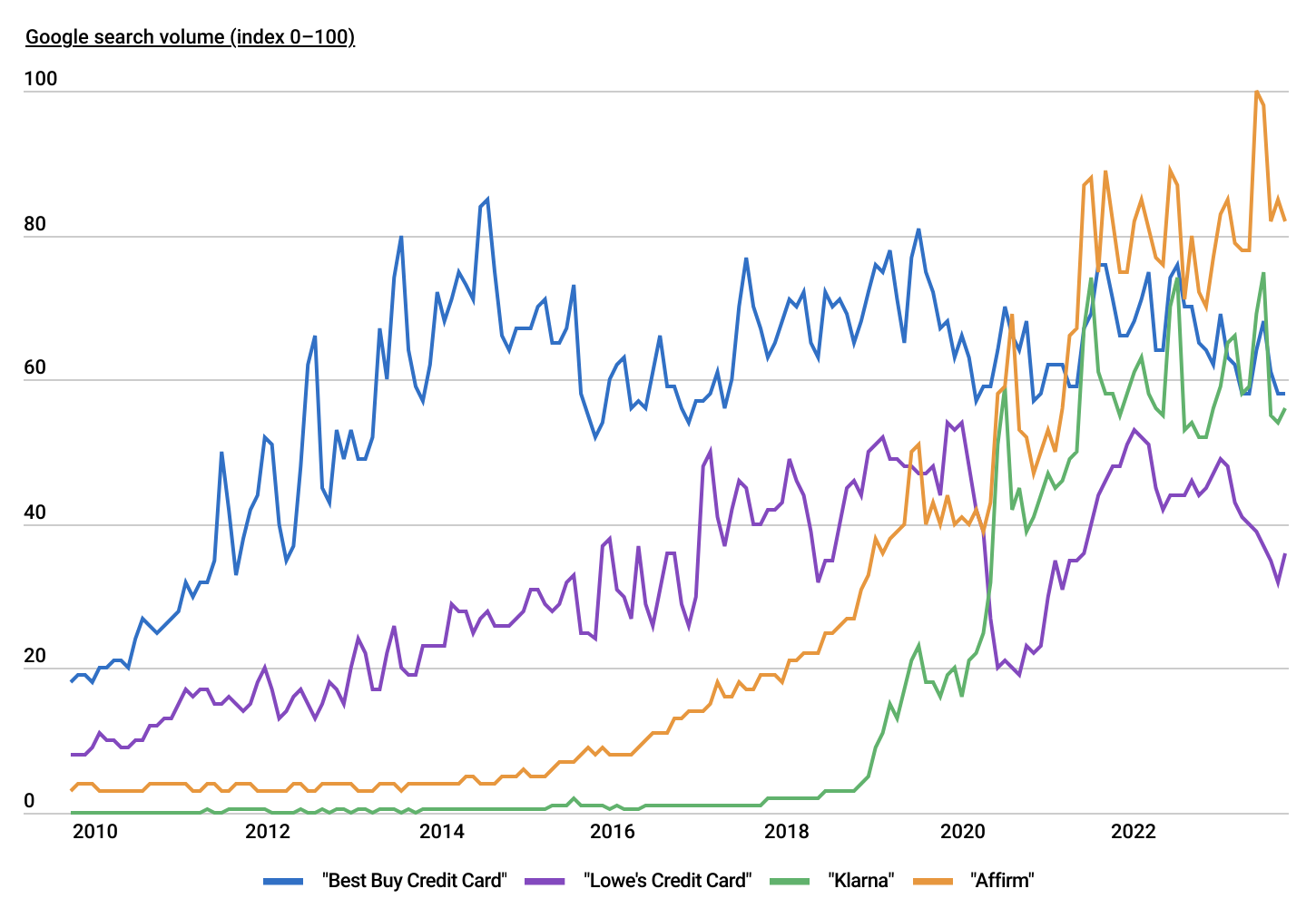

Amid high APRs and the rise of other payment forms, interest in store credit cards has waned. Image Credit: Upgraded Points

As consumers have wisened up to the less favorable terms of store-issued cards, they have increasingly turned to the versatility of general-purpose cards provided by financial institutions. Unlike their counterparts from previous decades, today’s bank-issued cards epitomize a thriving market, often featuring robust rewards programs—including cash back, travel points, and various incentives—designed to attract and retain consumers.

Threats to retail cards have also emerged from the growth of “buy now, pay later” services such as Klarna, Affirm, and Afterpay. These technology-enabled services allow consumers to finance purchases at the point of sale by paying in installments, usually with low or no interest. Consumer interest in these services has exploded since the e-commerce boom of the pandemic, particularly among younger and lower income shoppers. In turn, consumers’ likelihood to seek out store credit cards is waning, posing risks for stores who rely on these cards to drive revenues.

While consumers have more options than ever, there may still be good reasons for shoppers to obtain store-issued credit cards. As with most forms of credit, managing funds responsibly and keeping up with balances is the key to maximizing the benefits of store-issued cards. And despite softening demand, retail credit still accounts for about 12% of the total credit card market based on outstanding debt.

Top Store Credit Cards by State

Image Credit: Upgraded Points

Among the dozens of common retail credit cards available, the nation’s most popular cards originate from six prominent retailers—Best Buy, Home Depot, Lowe’s, Target, Walmart, and Costco—based on Google Search data over the past 12 months.

Notably, Best Buy, the electronics retailer, claims the title of having the most popular store credit cards in 22 U.S. states, predominantly in the Midwest and West. However, the home improvement sector emerges as the primary driver of interest in store cards across much of the nation. Combined, Home Depot (in 14 states) and Lowe’s (in 12 states) represent the most sought-after store credit cards in the majority of U.S. states. Interestingly, while the Northeast tends to favor Home Depot, the Southeast favors Lowe’s.

Among general retailers, Costco’s card reigns supreme in Montana and Hawaii. Surprisingly, while Walmart enjoys widespread popularity across numerous states, it does not hold the distinction of having the most searched-for card in any state.

Below is a complete breakdown of the most popular store credit cards in all 50 states. The analysis was conducted by Upgraded Points using data over the past 12 months from Google Trends. For more information, refer to the methodology section below.

Methodology

Photo Credit: Suradech Prapairat / Shutterstock

The study utilized U.S. search volume data from Google Trends to determine the top store credit cards across states. The initial analysis encompassed data from over 20 retailers offering store credit cards, which was subsequently narrowed down to the six most popular national retailers—Best Buy, Home Depot, Lowe’s, Target, Walmart, and Costco—based on search volume for their associated store cards.

To determine the top store card for each state, Upgraded Points compared Google searches over the trailing 12 months ending March 20, 2024. Specifically, search traffic for each retailer’s name combined with the term “credit card” determined relative popularity. The store card with the highest volume of search traffic in each state was deemed the most popular. Additionally, researchers included the relative breakdown of store-card-related internet searches for each of the six brands.

For complete results, see The Most Popular Store Credit Cards in Every State on Upgraded Points.