What We've Been Playin'

It's BUFFALO DAYS in Jamestown! What's your favorite part of the annual event?

Voting Ends: Jul 28, 2025 | 7:00 AM

Video Player

00:00

00:00

Local News

Benson County Sheriff Ethan Rode Resigns

The Benson County Sheriff is resigning a day after...

12h ago

Fargo Police Confirm Industrial Workplace Death

A worker at Mid America Steel in Fargo died on Tue...

20h ago

Texas Ag Attempting to Control NWS

Texas Agriculture Commissioner Sid Miller has anno...

18h ago

Governor Armstrong Appoints Grand Forks Prosecutor Andrew Eyre as District Judge

Governor Kelly Armstrong appointed Grand Forks Cou...

Jul 24, 2025

ND Dept of Agriculture Announces Funding for Drone-Based Weed Detection Project

North Dakota Agriculture Commissioner Doug Goehrin...

18h ago

Severe Weather Possible Throughout North Dakota on Friday

Storms and possible severe weather will again be a...

20h ago

Sports News

Jefferson Calls for Patience with New QB McCarthy

The best wide receiver in the NFL is calling for f...

15h ago

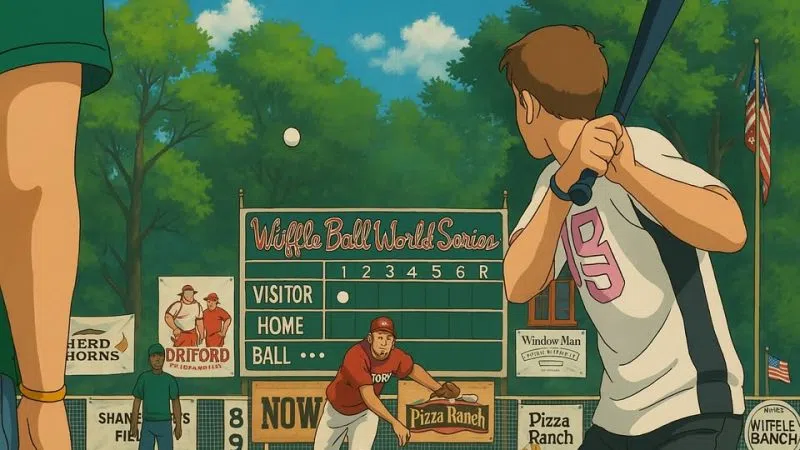

Final Valley City Wiffle Ball World Series This Weekend

Created by three Valley City High School graduates...

Jul 22, 2025

Wrestling Legend Hulk Hogan Dead at 71

Perhaps one of the most recognizable names in the ...

Jul 24, 2025

NFL Training Camp Officially Here, Vikings Return to the Field

Just about all 32 NFL teams have made it back to t...

Jul 22, 2025

NFL Training Camp Recap; July 24th

More updates on NFL training camp including an inj...

Jul 24, 2025

NFL Training Camp Recap; July 23rd

The NFL is officially back and teams are making th...

Jul 23, 2025

Weather

Country News

Hudson Westbrook Makes Emotional Debut At The Grand Ole Opry

Hudson Westbrook made an impressive Grand Ole Opry...

Jul 25, 2025

Asleep At the Wheel Share Video For Title Track To Forthcoming Album, 'Riding High In Texas,' Featuring Billy Strings

On Wednesday (July 23), Asleep at the Wheel, relea...

Jul 25, 2025

Luke Bryan Reveals That Lingering Effects Of COVID Have Caused Him To Cancel Multiple Shows

During his return to the stage last week in Greenv...

Jul 25, 2025